MoneyTips.com is an online community and information resource, but we recognize that talking directly with a professional about your situation is often the best approach. To know more please browse: http://www.moneytips.com/about

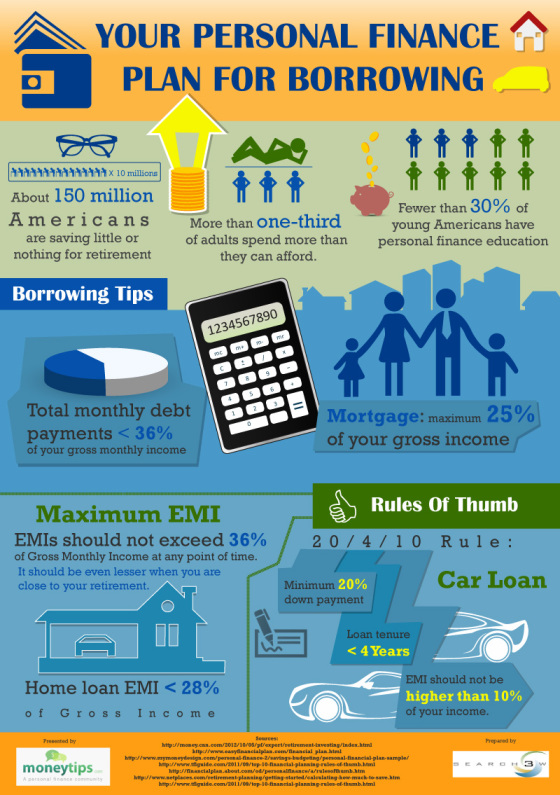

Your Personal Finance Plan for Borrowing Everyone wants to have a rewarding and happy life, making financial planning an integral part of our lives. We must manage our finances in such a manner that there is no space for any type of discrepancies in the future. Sound financial planning allows you to save for old age, various ailments, and certain unknown events. It is therefore extremely important to keep the below mentioned points in mind when planning your finances –

• The EMI should not exceed 36% of your gross monthly income. In case when your retirement is close, keep the EMI even lower.

• Your total monthly debt payments should not be more than 36% of your gross monthly income.

• The EMI should not exceed 28% in case of home loan.

• When planning to apply for a car loan, always make sure that you make 20% of the down payment on your own. Furthermore, a car loan should never be more than 4 years and the EMI should not be higher than 10% of your total income.

Managing finances is very important to ensure that your daily needs are met without any hardship. Keep these tips in mind and ensure proper management of your finances.